US Trade Deficit Hits Record $140.5B as Trump Tariffs Loom

The US trade deficit surged 14% to an unprecedented $140.5 billion in March 2024, driven by businesses rushing to boost imports ahead of new Chinese tariffs. The widening gap contributed to negative GDP growth, subtracting a record 4.83 percentage points in Q1.

UK Economic Downturn Fuels Expectations of Bank of England Rate Cuts

The Bank of England faces mounting pressure to cut interest rates as UK economic indicators signal weakening conditions, with falling consumer confidence and rising business distress. Financial markets anticipate rate cuts starting in May, though the central bank must balance growth support against persistent inflation risks.

Treasury Yields Surge Following Strong April Jobs Report

U.S. Treasury yields climbed significantly after April's employment data exceeded expectations, with nonfarm payrolls rising by 177,000 jobs versus the estimated 133,000. The robust figures have influenced Federal Reserve rate expectations while coinciding with potential renewed U.S.-China trade talks.

Treasury Market Turmoil: A Wake-Up Call for the US Economy

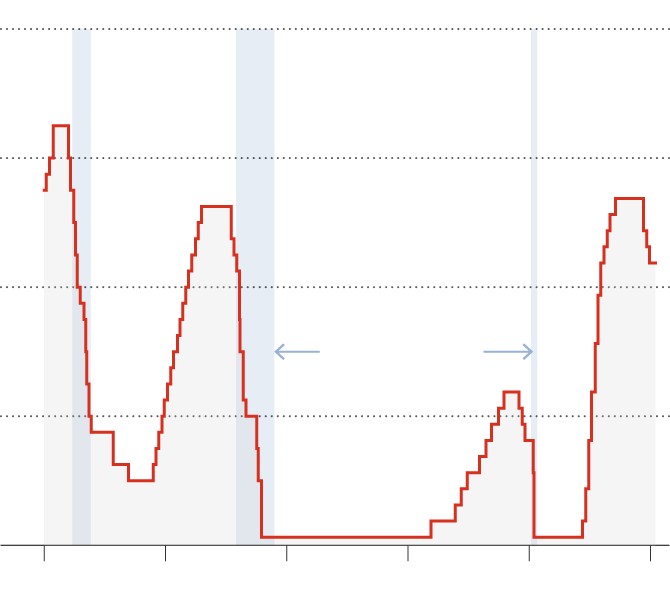

Recent dramatic movements in US Treasury yields have rattled financial markets, with the 10-year yield surging to 4.5% amid growing economic uncertainty. The volatility signals deeper concerns about US economic outlook while threatening higher borrowing costs for Americans and businesses alike.

Foreign Investors Stage Massive Exodus from U.S. Stock Market Amid Trade Tensions

Foreign investors are rapidly offloading U.S. stocks, particularly in the tech sector, as trade disputes and recession fears intensify. The semiconductor industry has been hit especially hard, with key indicators showing dramatic declines while major institutions warn of increasing economic risks.

Trump Ally Warns of Economic Catastrophe Over Sweeping New Tariff Policy

Billionaire Bill Ackman and other prominent business leaders caution that Trump's aggressive new tariff plan could trigger severe economic fallout. The policy imposes duties up to 50% on global imports, sparking market turmoil and threats of retaliation from trading partners.

Goldman Sachs Raises US Recession Risk to 35% as Economic Storm Clouds Gather

Goldman Sachs has increased its US recession probability forecast to 35%, citing concerns over tariffs, consumer confidence, and economic uncertainties. The investment bank predicts three Fed rate cuts in 2023 while lowering GDP growth estimates amid mounting challenges including massive government debt refinancing needs.

Global Markets Tumble as Trump's 'Liberation Day' Trade Policy Looms

Stock markets worldwide face turbulence as investors brace for Trump's imminent 'Liberation Day' trade policy changes, with major indices recording significant losses. Safe-haven assets surge while Goldman Sachs raises recession probability to 35% amid concerns over planned reciprocal tariffs.

Federal Reserve Maintains Rates, Signals Economic Caution with Growth Forecast Cut

The Federal Reserve kept interest rates at 4.5% while lowering its 2025 GDP growth forecast to 1.7%, citing economic uncertainties and persistent inflation concerns. Chairman Powell emphasized steady progress but acknowledged tariff impacts are delaying the path to the 2% inflation target.

Trump's Mexico Tariff Delay Fails to Calm Nervous Markets

President Trump announces one-month postponement of 25% Mexican import tariffs despite progress on border security and drug trafficking. Markets continue downward trend as trade tensions escalate with Canada and economic experts warn of inflation risks.