US Trade Deficit Hits Record $140.5B as Trump Tariffs Loom

The US trade deficit surged 14% to an unprecedented $140.5 billion in March 2024, driven by businesses rushing to boost imports ahead of new Chinese tariffs. The widening gap contributed to negative GDP growth, subtracting a record 4.83 percentage points in Q1.

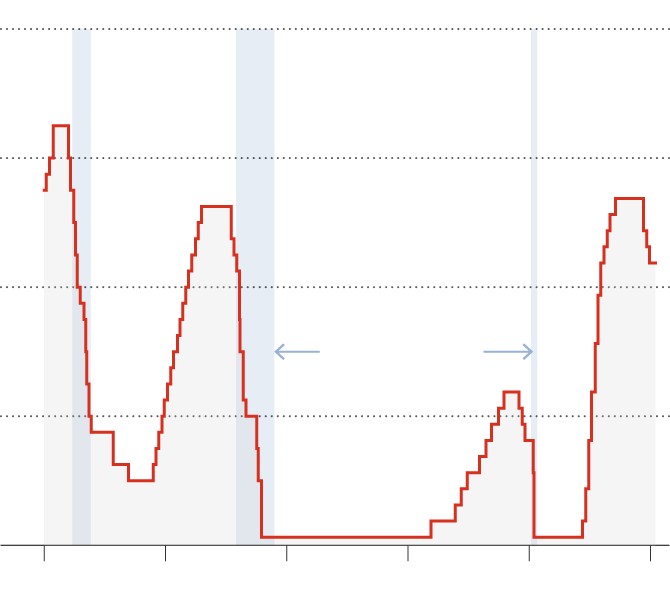

Treasury Market Turmoil: A Wake-Up Call for the US Economy

Recent dramatic movements in US Treasury yields have rattled financial markets, with the 10-year yield surging to 4.5% amid growing economic uncertainty. The volatility signals deeper concerns about US economic outlook while threatening higher borrowing costs for Americans and businesses alike.

Goldman Sachs Raises US Recession Risk to 35% as Economic Storm Clouds Gather

Goldman Sachs has increased its US recession probability forecast to 35%, citing concerns over tariffs, consumer confidence, and economic uncertainties. The investment bank predicts three Fed rate cuts in 2023 while lowering GDP growth estimates amid mounting challenges including massive government debt refinancing needs.

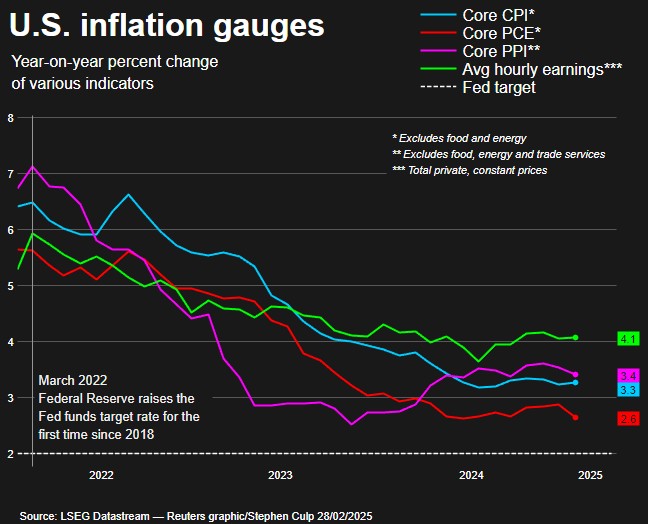

Federal Reserve Maintains Rates, Signals Economic Caution with Growth Forecast Cut

The Federal Reserve kept interest rates at 4.5% while lowering its 2025 GDP growth forecast to 1.7%, citing economic uncertainties and persistent inflation concerns. Chairman Powell emphasized steady progress but acknowledged tariff impacts are delaying the path to the 2% inflation target.

U.S. Private Sector Job Growth Hits 7-Month Low as Economy Shows Signs of Cooling

Private employers added just 77,000 jobs in February 2024, falling short of expectations and marking the smallest monthly gain since July. While leisure and hospitality showed strength, key sectors like transportation and education saw significant job losses amid growing economic uncertainty.

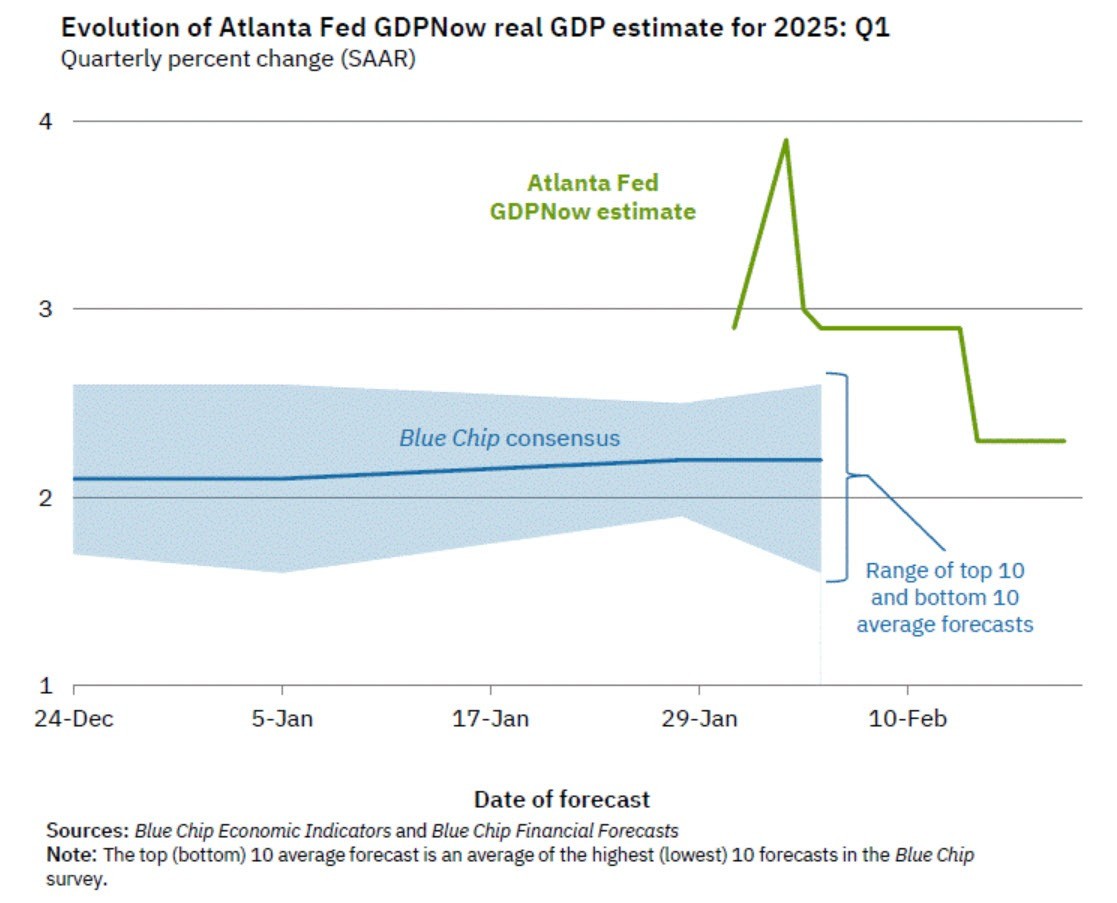

Atlanta Fed's GDP Forecast Plunges as Trade Deficit and Consumer Spending Raise Red Flags

The Atlanta Federal Reserve's GDPNow model has drastically cut its Q1 2025 growth forecast from +2.3% to -1.5%, marking one of the steepest declines ever recorded. The dramatic revision stems from an expanding trade deficit and weakening consumer spending, though analysts note these early projections could shift as more data becomes available.

U.S. Consumer Spending Dips as Inflation Edges Higher in January

U.S. consumer spending unexpectedly fell 0.2% in January amid severe winter weather, while inflation showed a modest uptick with PCE rising 0.3%. The mixed economic signals come as markets anticipate potential Federal Reserve rate cuts by mid-year.

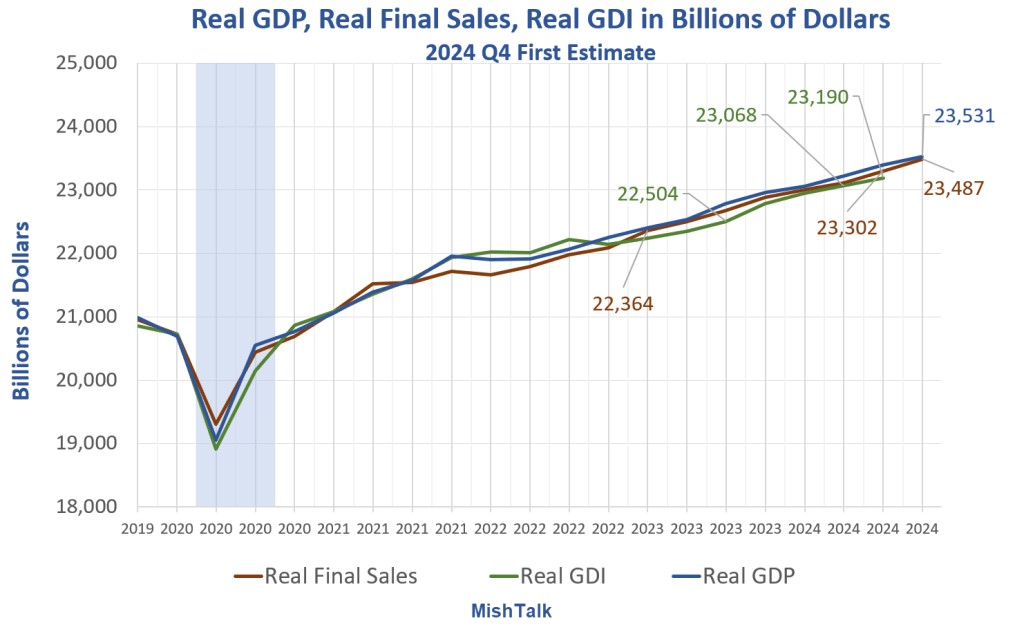

U.S. GDP Growth Holds Steady at 2.3% in Q4 2024, Inflation Edges Higher

The U.S. economy maintained 2.3% growth in Q4 2024 according to revised estimates, marking a moderate slowdown from Q3's 3.1% expansion. Key inflation measures saw slight upward revisions, with core PCE rising to 2.7% amid steady full-year growth of 2.8%.