Block Stock Plunges After Missing Revenue Targets and Lowering Guidance

Block's shares dropped 17% following disappointing Q1 results, with revenue falling to $5.77 billion against expected $6.2 billion. The fintech company lowered its profit outlook for 2024 amid economic uncertainty, despite achieving record profitability with 9% gross profit growth.

Wall Street's Trump Miscalculation: The $5 Trillion Reality Check

Wall Street's cozy relationship with Donald Trump imploded after his surprise tariff announcement wiped $5 trillion from markets. Financial elites are now grappling with diminished influence as Trump prioritizes his populist base over Wall Street interests.

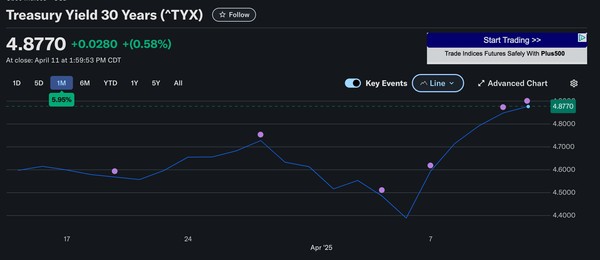

Markets Plunge as Trump Criticizes Fed Chair Amid Trade Tensions

Former President Trump's attacks on Federal Reserve Chairman Powell and escalating global trade tensions triggered a sharp market selloff. The Dow dropped over 1,000 points while tech stocks faced steep declines amid concerns over Fed independence and tariff impacts.

JPMorgan CEO Jamie Dimon Sells $31.5M in Shares as Succession Plans Take Shape

Jamie Dimon, JPMorgan Chase's long-serving CEO, has sold $31.5M worth of shares amid talks of leadership transition by 2026. The sale follows a larger $150M stock offload in February 2024, marking a shift from his historical pattern of long-term holding.

The $70 Million Trade: Insider Information Suspected in Record-Breaking Market Move

A mysterious trader turned $2.5 million into $70 million in under an hour through perfectly-timed options trades before market-moving Trump news. The suspicious timing and unprecedented profits have sparked calls for increased scrutiny of zero-day options trading and market information flows.

Markets Plunge as Trump Stands Firm on Trade War with China

Wall Street faced its worst decline since 2020 as Trump doubled down on tariff policies against China, sending the S&P 500 near bear market territory. The President remained unmoved by market turbulence while global stocks tumbled and U.S. companies with Chinese exposure suffered significant losses.

Global Markets Plunge as Trump Unveils Unprecedented Import Tariffs

U.S. stock markets suffered their worst decline in five years following President Trump's announcement of sweeping new import tariffs affecting major trading partners. The dramatic policy shift threatens to disrupt global trade and push economies toward recession, with tariffs ranging from 10% to 46% on imported goods.

Global Markets Tumble as Trump's 'Liberation Day' Trade Policy Looms

Stock markets worldwide face turbulence as investors brace for Trump's imminent 'Liberation Day' trade policy changes, with major indices recording significant losses. Safe-haven assets surge while Goldman Sachs raises recession probability to 35% amid concerns over planned reciprocal tariffs.

Auto Loan Defaults Hit 30-Year High as Financial Pressures Mount

Car loan delinquencies have reached their highest level since 1994, with over 6.5% of subprime borrowers falling behind on payments. The crisis reflects broader economic challenges as Americans struggle with record-high car payments, depleted savings, and persistent inflation impacts.

Market Turmoil: Dow Suffers Worst Single-Day Drop of 2025 as Trump Tariff Fears Mount

Wall Street experienced a dramatic selloff with the Dow plunging 748 points amid concerns over proposed Trump administration tariffs and worrying economic data. Consumer sentiment hit lows while inflation expectations reached a 28-year high, driving investors toward defensive sectors.