Economic Outlook 2025: Steady Growth Amid Inflation and Labor Challenges

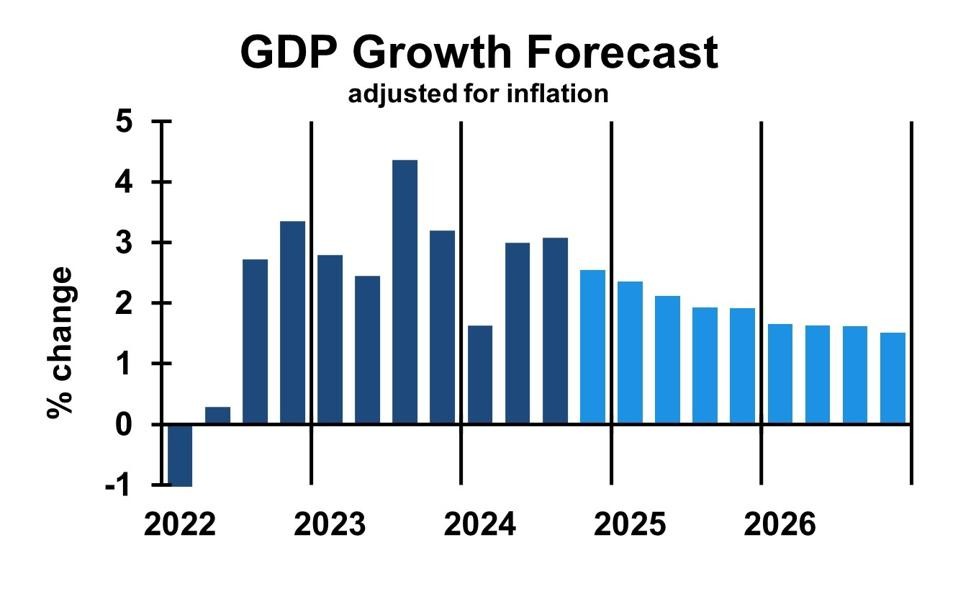

The U.S. economy projects moderate growth of 2.1% by late 2025 despite persistent inflation above the Fed's 2% target. While recession risks remain low, businesses must navigate labor constraints, supply chain risks, and restrictive monetary policy.

Mortgage Applications Plummet 22% as Interest Rates Climb to End 2024

Mortgage applications saw a dramatic 21.9% decline in late December 2024 as interest rates approached 7% for 30-year fixed loans. The sharp downturn affected both refinance and purchase applications, highlighting ongoing challenges in the housing market due to elevated borrowing costs.

US Mortgage Rates Surge to 6.91%, Reaching Six-Month High

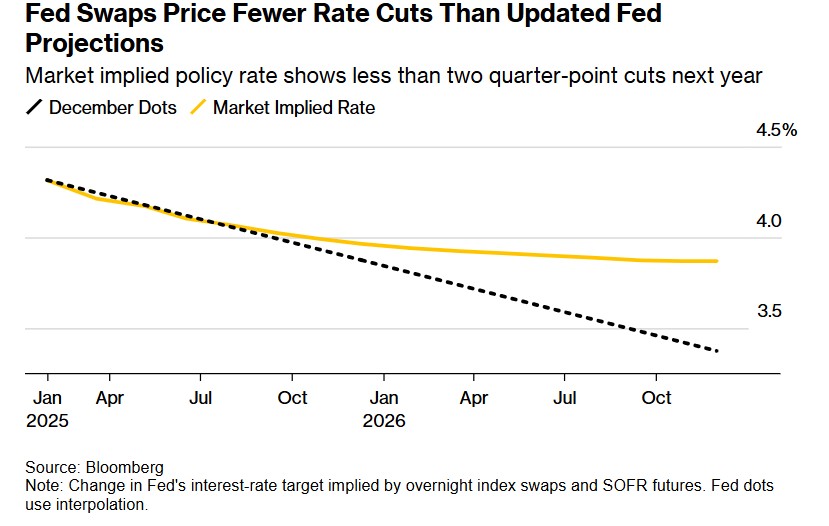

The benchmark 30-year fixed mortgage rate in the US hit 6.91%, its highest level since July, while 15-year rates climbed to 6.13%. The Federal Reserve's revised forecast for fewer rate cuts and persistent inflation concerns continue to drive mortgage costs higher.

U.S. Treasury Faces $3 Trillion Debt Refinancing Challenge in 2025

The bond market enters 2025 grappling with unprecedented $3 trillion U.S. debt maturity while still reeling from 2024's difficulties. Treasury Department must navigate complex refinancing of short-term bills amid market pressures and evolving Federal Reserve policy.

U.S. Credit Card Defaults Surge to 14-Year High, Signaling Consumer Financial Strain

Credit card defaults have reached their highest level since 2010, with lenders writing off $46 billion in seriously delinquent loans during the first nine months of 2024. The sharp rise in defaults, particularly among younger and paycheck-to-paycheck borrowers, points to mounting pressure on household finances after years of high inflation.

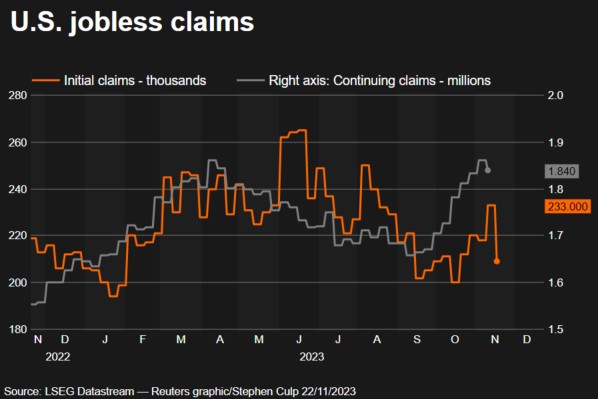

US Weekly Jobless Claims Plunge to 220,000, Signaling Strong Labor Market

Initial unemployment claims dropped by 22,000, surpassing economists' forecasts and highlighting the resilience of the US job market. The decline suggests employers are maintaining workforces despite economic uncertainties, potentially boosting consumer confidence ahead of the holiday season.

Oil Prices Tumble as China Demand Concerns and Strong Dollar Shake Markets

Global oil benchmarks face steep weekly losses as China's projected peak demand and strengthening U.S. dollar pressure markets. Brent crude falls to $72.55 while analysts predict supply surpluses, suggesting continued bearish conditions ahead.

Federal Judge Blocks Historic $25B Kroger-Albertsons Grocery Merger

A federal court has halted Kroger's proposed $25 billion acquisition of Albertsons, siding with FTC concerns over reduced competition and consumer impacts. The ruling derails what would have been one of the largest U.S. grocery retail mergers, despite the companies' arguments about competing with major retailers like Walmart and Amazon.

Fed Signals More Cautious Approach with Two Rate Cuts Projected for 2025

The Federal Reserve revises its interest rate outlook, reducing projected cuts from four to two for 2025 amid persistent inflation concerns. Chair Powell acknowledges progress in inflation reduction but notes recent stagnation, leading to a more conservative approach that surprised markets.