Goldman Sachs Raises US Recession Risk to 35% as Economic Storm Clouds Gather

Goldman Sachs has increased its US recession probability forecast to 35%, citing concerns over tariffs, consumer confidence, and economic uncertainties. The investment bank predicts three Fed rate cuts in 2023 while lowering GDP growth estimates amid mounting challenges including massive government debt refinancing needs.

Consumer Confidence Hits 12-Year Low as Americans Brace for Economic Uncertainty

U.S. consumer confidence plunged to its lowest level since 2012, with the Conference Board's index dropping 7.2 points amid inflation concerns and trade policy shifts. Major retailers like Walmart and Target are already seeing impacts, while business leaders grow increasingly pessimistic about recession risks.

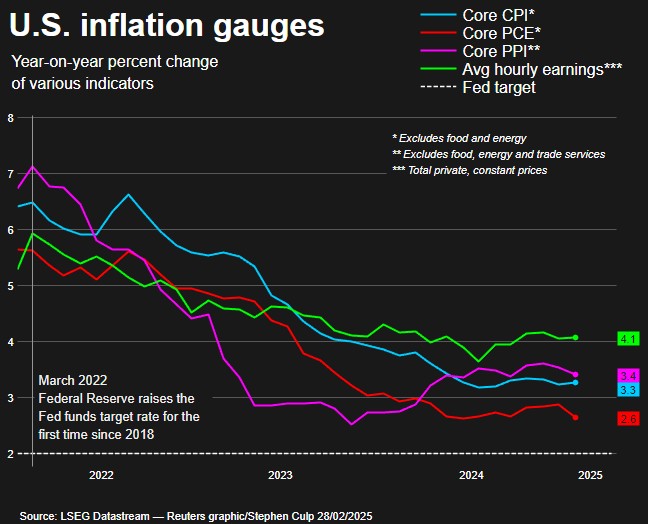

Federal Reserve Maintains Rates, Signals Economic Caution with Growth Forecast Cut

The Federal Reserve kept interest rates at 4.5% while lowering its 2025 GDP growth forecast to 1.7%, citing economic uncertainties and persistent inflation concerns. Chairman Powell emphasized steady progress but acknowledged tariff impacts are delaying the path to the 2% inflation target.

U.S. Private Sector Job Growth Hits 7-Month Low as Economy Shows Signs of Cooling

Private employers added just 77,000 jobs in February 2024, falling short of expectations and marking the smallest monthly gain since July. While leisure and hospitality showed strength, key sectors like transportation and education saw significant job losses amid growing economic uncertainty.

Trump's Mexico Tariff Delay Fails to Calm Nervous Markets

President Trump announces one-month postponement of 25% Mexican import tariffs despite progress on border security and drug trafficking. Markets continue downward trend as trade tensions escalate with Canada and economic experts warn of inflation risks.

Auto Loan Defaults Hit 30-Year High as Financial Pressures Mount

Car loan delinquencies have reached their highest level since 1994, with over 6.5% of subprime borrowers falling behind on payments. The crisis reflects broader economic challenges as Americans struggle with record-high car payments, depleted savings, and persistent inflation impacts.

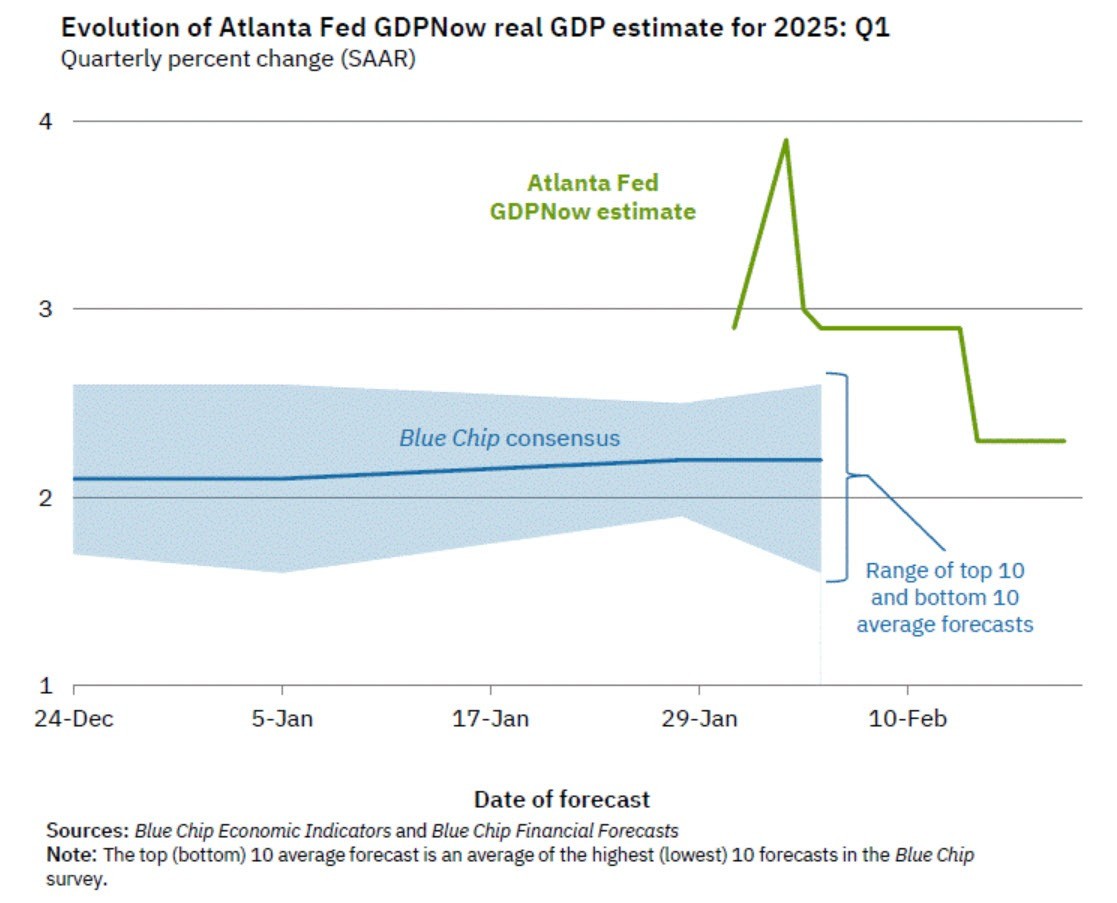

Atlanta Fed's GDP Forecast Plunges as Trade Deficit and Consumer Spending Raise Red Flags

The Atlanta Federal Reserve's GDPNow model has drastically cut its Q1 2025 growth forecast from +2.3% to -1.5%, marking one of the steepest declines ever recorded. The dramatic revision stems from an expanding trade deficit and weakening consumer spending, though analysts note these early projections could shift as more data becomes available.

U.S. Consumer Spending Dips as Inflation Edges Higher in January

U.S. consumer spending unexpectedly fell 0.2% in January amid severe winter weather, while inflation showed a modest uptick with PCE rising 0.3%. The mixed economic signals come as markets anticipate potential Federal Reserve rate cuts by mid-year.

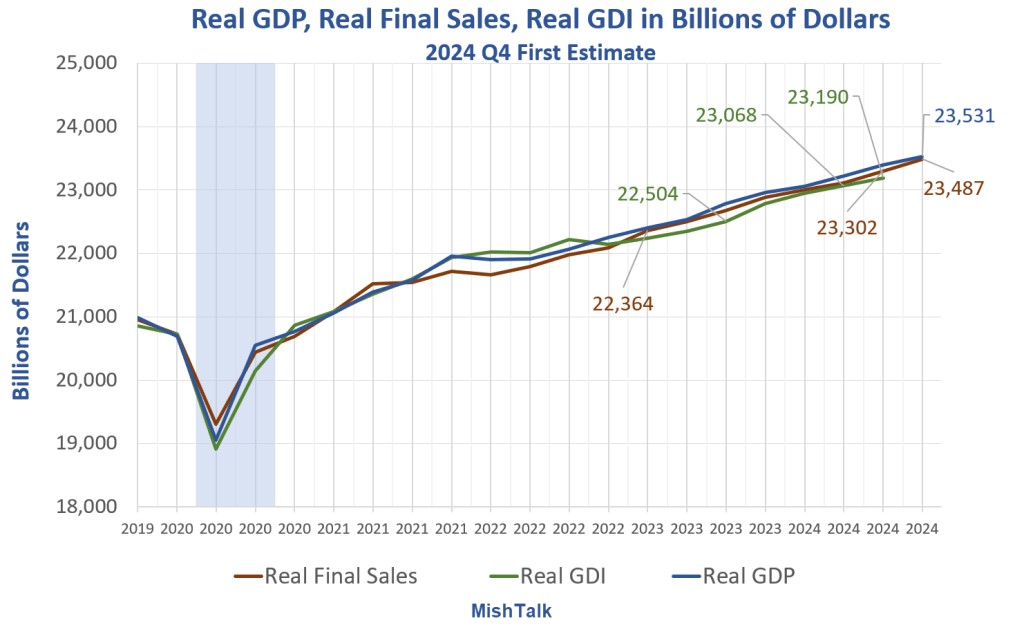

U.S. GDP Growth Holds Steady at 2.3% in Q4 2024, Inflation Edges Higher

The U.S. economy maintained 2.3% growth in Q4 2024 according to revised estimates, marking a moderate slowdown from Q3's 3.1% expansion. Key inflation measures saw slight upward revisions, with core PCE rising to 2.7% amid steady full-year growth of 2.8%.

Market Turmoil: Dow Suffers Worst Single-Day Drop of 2025 as Trump Tariff Fears Mount

Wall Street experienced a dramatic selloff with the Dow plunging 748 points amid concerns over proposed Trump administration tariffs and worrying economic data. Consumer sentiment hit lows while inflation expectations reached a 28-year high, driving investors toward defensive sectors.