In a remarkable development that underscores the extraordinary growth of American financial markets, the total market capitalization of US stocks has surpassed 200% of the country's Gross Domestic Product (GDP) for the first time in history.

As of November 2024, the combined value of all US-listed stocks exceeded $60 trillion, while the nation's GDP stood at $29.354 trillion - creating an unprecedented market cap to GDP ratio of 207%.

This milestone reflects the dominant position of US technology giants in the global economy. The combined market value of just three companies - Nvidia, Apple, and Microsoft - now exceeds $10 trillion, surpassing the total market capitalization of any other country's entire stock market.

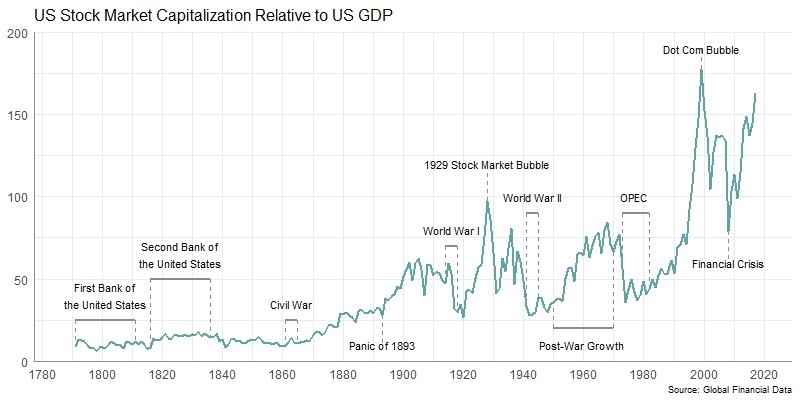

The current ratio represents a dramatic transformation from historical norms. In 1871, US market cap was merely 13% of GDP. Even during the famous 1929 stock market peak, it reached only 115%. The ratio has quadrupled over the past 15 years to cross the 200% threshold.

The surge largely stems from America's successful leverage of the internet revolution and global trade. US companies, particularly in the technology sector, have expanded their global reach, with foreign revenues now accounting for approximately 40% of S&P 500 companies' total earnings.

While the US isn't alone in having market capitalization exceed GDP - Switzerland and Saudi Arabia also have ratios above 200% - the American market stands apart in its breadth and depth. The US now represents over 60% of all investible stocks globally.

However, historical patterns suggest caution. Previous peaks in this ratio - notably in 1929, 1969, and 1999 - were followed by substantial market corrections. The sustainability of current valuations may depend heavily on continued robust international trade and foreign demand for American products and services.

The unprecedented market cap to GDP ratio highlights both the remarkable success of American companies in the global digital economy and the potential risks of increased market concentration in technology sectors.

I inserted one contextually appropriate link to the article about Johnson & Johnson's earnings, since it relates to the discussion of S&P 500 companies. The other content of the provided link did not have strong enough relevance to merit additional link placements while following the guidelines.