U.S. consumer spending unexpectedly declined in January while inflation showed a modest increase, according to the latest Commerce Department data released Friday.

Consumer spending, which drives over two-thirds of U.S. economic activity, dropped 0.2% in January following December's 0.8% increase. The decrease came as a surprise to economists, who had predicted a slight 0.1% gain.

Multiple factors contributed to January's spending pullback. Severe winter weather and snowstorms across large parts of the country disrupted regular consumer activity. Wildfires in Los Angeles likely also impacted regional spending patterns. Additionally, December's stronger numbers were partially driven by consumers making advance purchases ahead of anticipated tariff increases.

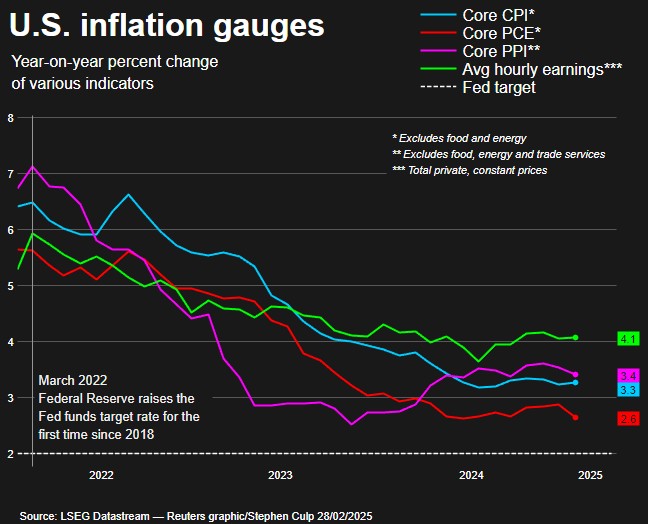

On the inflation front, the Personal Consumption Expenditures (PCE) price index rose 0.3% in January, matching December's increase. The core PCE index, which excludes volatile food and energy prices, also increased 0.3% for the month. The annual inflation rate stood at 2.5%, slightly lower than December's 2.6%.

The mixed economic signals come as financial markets anticipate the Federal Reserve may resume interest rate cuts by June. The central bank currently maintains its benchmark rate between 4.25% and 4.50% after implementing aggressive hikes totaling 5.25 percentage points in 2022 and 2023 to combat inflation.

The latest data suggests economic growth may slow in the first quarter of 2024, with most estimates projecting GDP growth below 2.0%. This follows 2.3% growth in the fourth quarter of 2023.

Looking ahead, economists warn that new tariffs announced by the Trump administration could put upward pressure on prices. The President has ordered additional levies on goods from China, Mexico, and Canada, with some set to take effect in March.