Perion Network Ltd. (NASDAQ: PERI) saw its stock price plummet over 40% on Monday after announcing disappointing preliminary Q1 2024 results and lowering its full-year guidance, primarily due to changes in Microsoft Bing's search advertising marketplace.

The digital advertising technology company now expects Q1 2024 revenue of $157 million, representing 8% year-over-year growth but falling well short of Wall Street's projected $175.5 million. The company's adjusted EBITDA is anticipated to drop 36% to $20 million compared to the same period last year.

The dramatic decline stems from reduced Search Advertising performance after Microsoft Bing altered its pricing and mechanisms in its Search Distribution marketplace. These changes decreased Revenue Per Thousand Impressions (RPM) for Perion and other Bing partners, leading to lower search volumes.

For the full year 2024, Perion slashed its revenue guidance to $590-610 million from the previous $860-880 million range. The company also reduced its adjusted EBITDA forecast to $78-82 million, down from $178-182 million initially projected.

Despite these headwinds, CEO Tal Jacobson emphasized the company's strong relationship with Microsoft and ongoing efforts to diversify revenue streams. "Our strategy was, and continues to be, grounded in a fundamental principle of making sure our solutions are diversified in terms of technologies, channels and partners," stated Jacobson.

The company highlighted its expanding Display Advertising segment, including AI-driven Connected TV, Retail Media, and Digital out-of-home solutions, which maintained solid performance in Q1. Management also announced an increase in its share buyback program from $50 million to $75 million, demonstrating confidence in the company's long-term prospects.

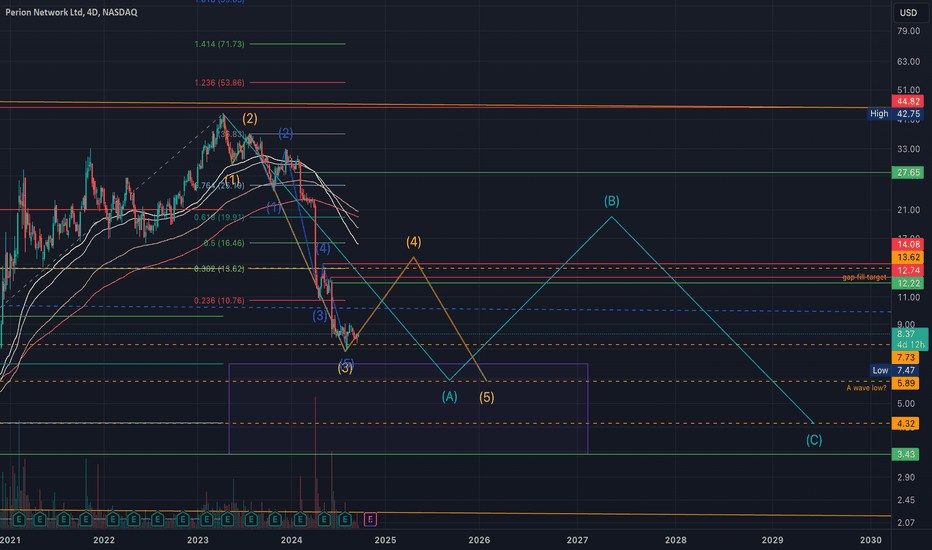

PERI shares closed Monday at $12.50, down 40.79% from the previous close of $21.11. The stock showed signs of recovery on Tuesday, rising 3.12% to $12.89 by early afternoon trading.

Wall Street analysts remain optimistic about Perion's future, maintaining an average 12-month price target of $32.80, suggesting potential upside of over 160% from current levels. The company's market capitalization stands at approximately $588 million, with a three-month average trading volume of 749,040 shares.