The Federal Reserve maintained interest rates at 4.5% during its March 2025 meeting while revising down economic growth forecasts, reflecting increased uncertainty in the economic outlook.

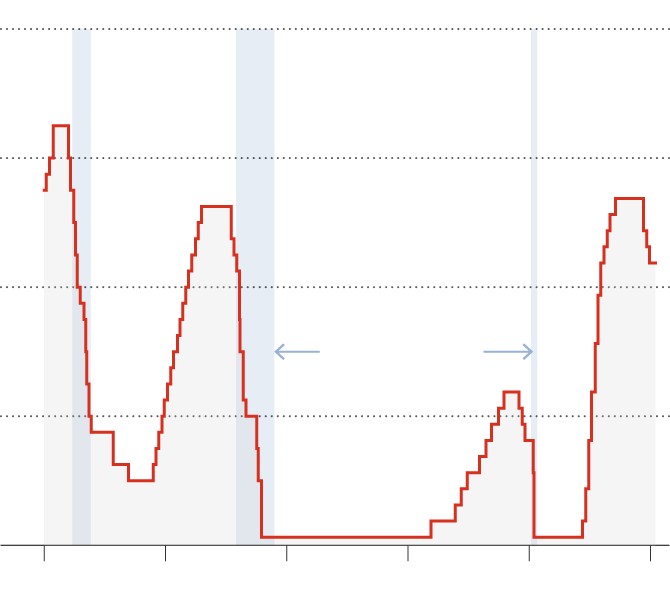

This marks the second consecutive meeting where rates remained unchanged, following three rate cuts between September and December 2024 that brought rates down from 5.5% to the current level.

Fed Chairman Jerome Powell cited steady economic progress and solid labor market conditions as key factors behind the decision. While inflation remains above target, it has shown improvement, with core consumer prices rising 2.6% year-over-year in January 2025, down from 3.1% a year earlier.

The Fed's updated economic projections revealed several notable changes:

- 2025 GDP growth forecast lowered to 1.7% from 2.1%

- Core inflation projection raised to 2.8% from 2.5%

- Year-end unemployment rate estimate increased to 4.4% from 4.3%

The central bank also announced plans to slow its quantitative tightening program in April by reducing monthly Treasury redemptions to $5 billion from $25 billion. One committee member, Christopher Waller, dissented on this decision, preferring to maintain the current pace of balance sheet reduction.

During the press conference, Powell acknowledged that recent tariff changes have contributed to elevated inflation forecasts and delayed progress toward the Fed's 2% target. The Fed now expects inflation to reach its target around 2026 or 2027.

The FOMC statement reflected growing economic uncertainty by removing language about balanced risks and instead emphasizing increased uncertainty in the outlook. Despite these challenges, Powell indicated that the "solid" economic backdrop provides room for careful assessment of recent policy changes before making further rate adjustments.

The Fed maintained its projection of two rate cuts in 2025, though fewer committee members supported additional cuts compared to previous meetings. The central bank appears positioned to maintain its wait-and-see approach while monitoring economic developments in the coming months.