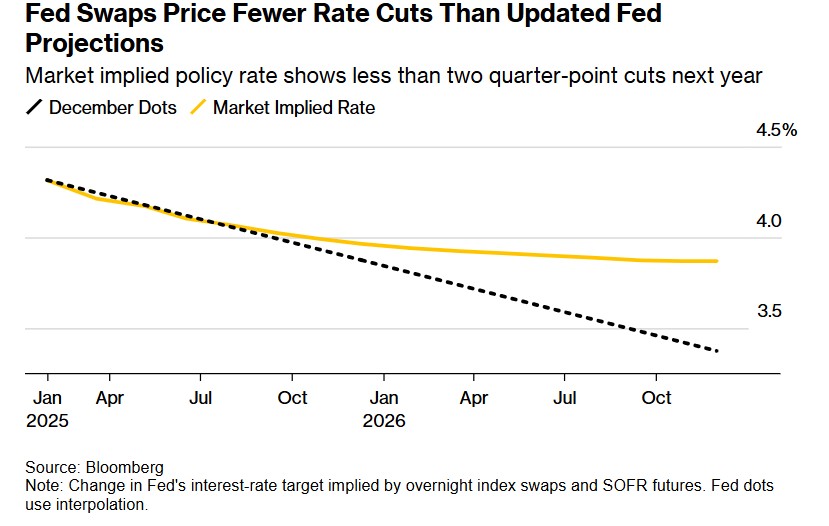

The Federal Reserve has revised its interest rate outlook for 2025, now projecting just two quarter-point rate cuts instead of the four cuts forecasted earlier in September. This more conservative approach comes amid recent economic data showing persistent inflation and robust growth.

At its final policy meeting of the year, the Fed lowered its benchmark interest rate to a target range of 4.25%-4.5%. However, the central bank's latest projections, known as the "dot plot," indicate a more measured pace of rate reductions ahead. The Fed now expects rates to fall to approximately 3.9% by the end of 2025.

The shift in outlook reflects the Fed's updated economic projections. The central bank raised its inflation expectations, with core inflation now projected at 2.8%, up from September's 2.6% forecast. GDP growth estimates were also revised upward to 2.5% for the full year.

Among Fed officials, 14 out of 19 members anticipate two quarter-point rate cuts or fewer in 2025. Looking further ahead, officials project two additional cuts in 2026 and one more in 2027, eventually reaching a "neutral" funds rate of 3%.

Fed Chair Jerome Powell noted that while progress has been made in lowering inflation from 5.6% to 2.8% since 2022, recent data shows inflation "moving sideways." This stalled progress toward the Fed's 2% target has prompted a more cautious approach to future rate reductions.

The announcement impacted financial markets, with the Dow Jones Industrial Average dropping 1,123 points following the news. The more conservative rate cut projection surprised many economists who had anticipated three cuts in 2025.

The Fed's revised outlook also includes a more optimistic view of the labor market, with the unemployment rate projection lowered to 4.2% from the previous 4.4% estimate.