European markets kicked off 2025 on a positive note, with energy stocks leading the charge amid rising crude oil prices and fresh U.S. economic data releases.

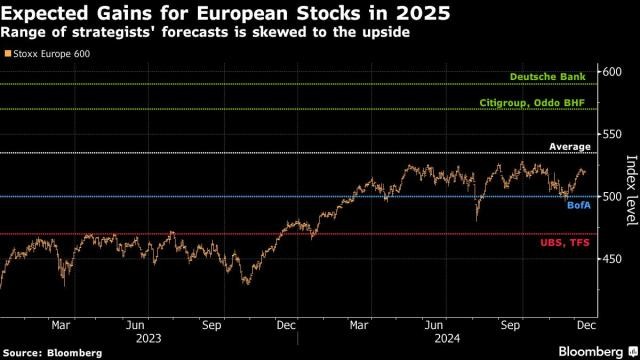

The pan-European STOXX 600 index climbed 0.6% to reach 510.67, overcoming early session losses despite relatively light trading volumes as investors returned from New Year holidays.

The energy sector emerged as the standout performer, surging 2.3% on the back of a 2% rise in crude oil prices. The uptick in oil markets followed Chinese President Xi Jinping's pledge to boost economic growth in the world's largest crude-importing nation.

Utilities and defense sectors also performed strongly, each advancing more than 1.5%. However, not all sectors shared in the optimism, as automobile manufacturers and luxury goods companies both declined by more than 0.4%.

While the STOXX 600 posted a 6% gain over 2024, market sentiment remains mixed. Ongoing political tensions in Germany and France, coupled with concerns about slowing economic growth across Europe, have cast shadows over the broader market outlook.

The positive start to 2025 comes despite the STOXX 600 experiencing its largest quarterly decline since late 2022 in the previous period. As trading volumes normalize following the holiday season, investors continue to monitor U.S. economic indicators for further direction.