The U.S. economy heads into 2025 with mixed signals - steady growth expectations paired with persistent inflation challenges, according to leading economic analysts. While a recession appears unlikely, several key factors will shape the economic landscape in the coming years.

Growth Outlook

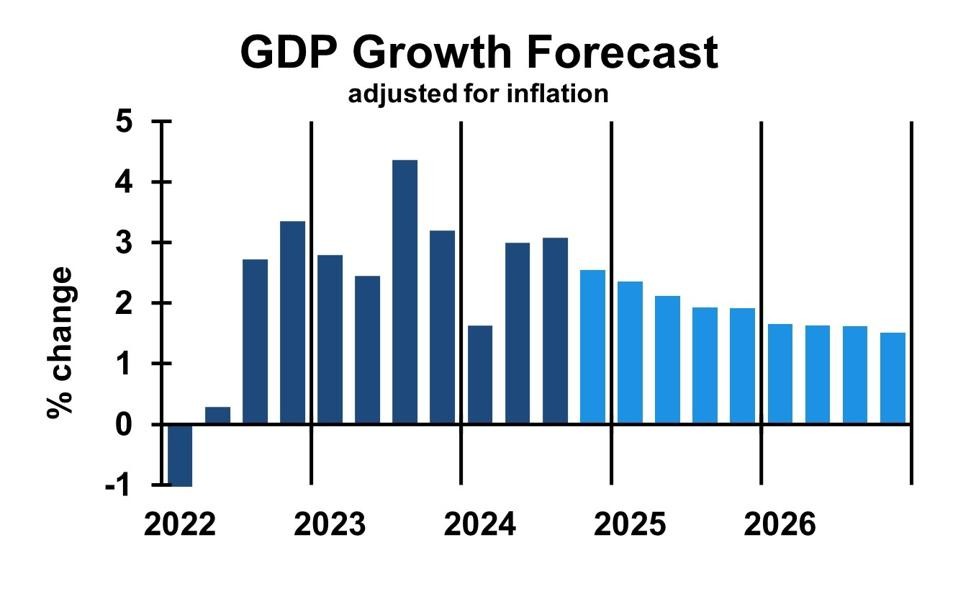

Economic growth is projected to moderate from 2.7% in 2024 to 2.1% by late 2025, with a further slowdown to 1.6% anticipated by the end of 2026. This cooling trend stems primarily from labor supply constraints rather than lack of demand.

Consumer spending remains robust, buoyed by healthy employment figures and wage increases outpacing inflation. Household bank balances continue to benefit from pandemic-era stimulus, though consumer borrowing shows modest expansion.

Construction activity presents a mixed picture - while data centers and semiconductor plants see increased investment, residential and commercial building face headwinds. Government spending maintains an upward trajectory across federal, state and local levels.

Inflation Persistence

The Federal Reserve's 2% inflation target remains elusive heading into 2025. Interest rates are expected to stay restrictive, with only minor adjustments anticipated - potentially one or two quarter-point cuts through the year.

Trade policies under the new administration, particularly regarding tariffs, may create additional inflationary pressures. While tariffs typically drive one-time price increases rather than sustained inflation, their cumulative impact warrants monitoring.

Key Risk Factors

Several elements could impact economic performance:

Labor Markets: Anticipated immigration restrictions may constrain workforce availability, particularly affecting sectors like construction, agriculture and hospitality

International Relations: Global conflicts could disrupt trade flows and supply chains

Infrastructure: The aging electrical grid poses reliability risks for power-intensive industries

Trade Policy: Potential trade disputes could slow growth, especially in sectors with complex supply networks

Technology as Growth Driver

Artificial intelligence adoption across healthcare, finance, manufacturing and technology sectors may boost worker productivity, partially offsetting labor constraints. However, analysts caution that near-term AI benefits may be limited compared to potential downside risks.

Business Implications

Companies are advised to focus on industry-specific supply risks rather than broad economic scenarios. Priority areas include:

- Supply chain resilience

- Workforce planning

- Infrastructure reliability

- Technology integration

The 2025 economic outlook suggests measured optimism tempered by ongoing challenges. While growth continues, businesses must navigate labor constraints, inflation pressures and policy shifts in an evolving economic landscape.