Atari SA (EPA:ALATA) has given its shareholders reason to celebrate, with an impressive 50% surge in share price over the past month. The gaming company's stock has maintained strong momentum, posting a solid 23% gain over the past year.

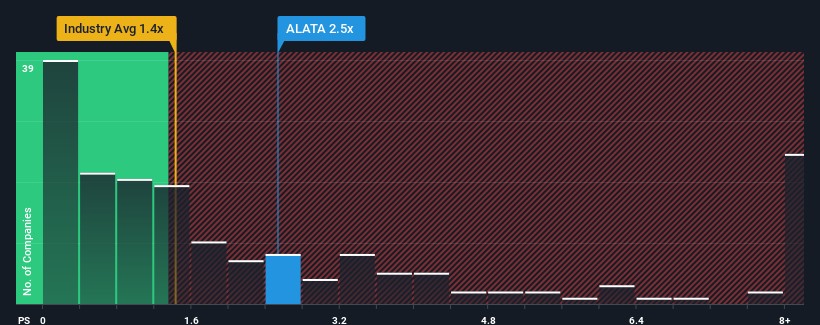

The recent price rally puts Atari's price-to-sales (P/S) ratio at 2.5x, notably higher than many of its French entertainment industry peers who trade below 0.6x. However, a deeper look at the company's performance helps explain the premium valuation.

Atari has demonstrated remarkable revenue growth, reporting a 129% increase over the past year. The company's three-year revenue trajectory shows a robust 63% total growth, substantially outpacing the industry's projected one-year growth rate of 4.7%.

This exceptional revenue performance appears to be driving investor confidence and supporting the elevated P/S ratio. Market participants seem convinced that Atari can maintain its strong growth trajectory, making them willing to pay a premium for the stock.

While the recent share price jump reflects investor optimism, potential investors should note that analysts have identified several risk factors for the company, including three that warrant serious attention.

The market's response suggests confidence in Atari's business model and growth prospects. However, the sustainability of this growth trajectory will likely remain a key focus for investors moving forward, particularly given the company's premium valuation relative to industry peers.

As Atari continues to navigate the competitive gaming and entertainment landscape, its ability to maintain strong revenue growth will be central to justifying its current market valuation and supporting future share price performance.