Dutch semiconductor equipment giant ASML Holding NV saw its stock jump nearly 10% following impressive fourth-quarter earnings that exceeded market expectations, while simultaneously highlighting artificial intelligence as a major growth catalyst.

The company reported record Q4 revenue of €9.3 billion ($9.71 billion), surpassing analyst estimates of $9.02 billion by 7.6%. Earnings per share came in at €6.85 ($7.15), beating projections of $6.71.

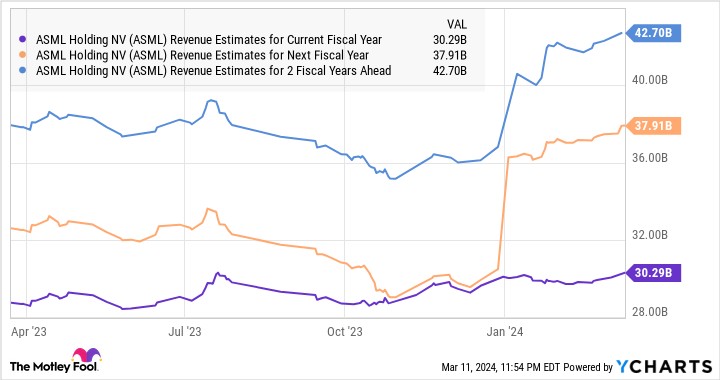

ASML CEO Christophe Fouquet emphasized AI's transformative role, stating that it "has created a shift in market dynamics" while projecting 2025 sales between €30-35 billion ($31.32-36.54 billion).

The positive earnings news comes after recent market volatility sparked by DeepSeek's emergence, which triggered a broad tech sector selloff. ASML shares had declined 6.68% in the two days prior to earnings, while its key customer Nvidia dropped 9.56%.

Industry experts remain bullish on both companies' prospects. Microsoft CEO Satya Nadella referenced the Jevons Paradox, suggesting AI usage will surge as it becomes more efficient and accessible. Meanwhile, Nvidia acknowledged DeepSeek's achievements using its H800 chips, noting that AI inference "requires significant numbers of Nvidia GPUs."

Wall Street maintains an optimistic outlook for ASML, with analysts setting an average price target of $880 per share, representing substantial upside potential from current levels.

The recent dip in both stocks, followed by ASML's strong results, may present an attractive entry point for investors looking to gain exposure to the expanding AI semiconductor sector.