Alphabet's stock price fell sharply on Wednesday after the Google parent company reported disappointing quarterly results, particularly in its cloud division, as the tech giant increases investments in artificial intelligence.

The company's shares tumbled 6% following the earnings announcement, dragging down the broader tech sector. Investors expressed concerns about Alphabet's growing AI-related expenses and the slower-than-expected progress in monetizing these investments.

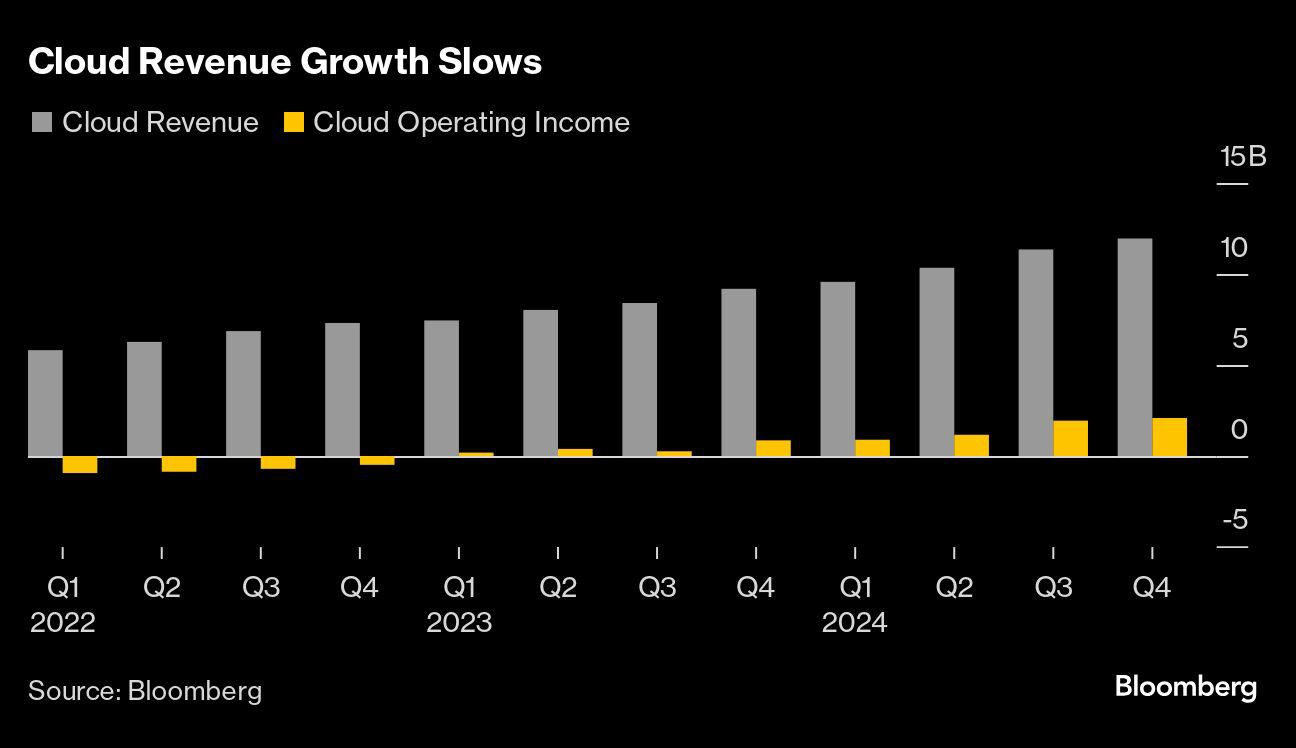

The main pain point came from Google Cloud, which posted revenue below Wall Street expectations. This underperformance raised questions about the company's ability to compete effectively in the cloud computing market against rivals like Microsoft and Amazon.

Beyond the cloud segment, Alphabet's overall revenue for the quarter also missed analyst estimates. The revenue shortfall, combined with higher spending on AI initiatives, sparked investor worries about the company's near-term growth prospects.

The stock decline occurred despite a generally positive day for U.S. markets, with the Dow Jones Industrial Average gaining over 300 points. While other tech giants like Nvidia saw their shares rise, Alphabet's disappointing results stood out as a notable weak spot in the sector.

Market analysts noted that while Alphabet's increased AI investments may benefit the company long-term, the current spending levels without immediate returns have made some investors nervous about the timeline for seeing meaningful financial results from these initiatives.